Celebrating Mary Hoffman

Mary Hoffman was a quiet person who lived at Wake Robin in Shelburne, VT. She loved music, nature, and community. When she passed away peacefully in 2024, Mary bequeathed money to seven Vermont organizations - including Shelburne Farms who received a six-figure gift. Her bequest was unrestricted so Shelburne Farms may use it where it is needed most.

“We didn’t know of Mary’s plans,” recalls Sue Dixon, Shelburne Farms Special Gifts Officer. “Her incredible thoughtfulness enables us to breathe a little easier as we strive daily to deliver our mission to educate for a sustainable future. We’re deeply grateful to all of our Legacy Circle members who have included Shelburne Farms in their estate plans. I only wish we’d had the chance to thank Mary for her kindness and generosity.”

Six organizations that benefited from Mary’s bequest - The Nature Conservancy, Shelburne Farms, Shelburne Museum, the Vermont Community Foundation, the Vermont Symphony Orchestra, and Wake Robin - held a special celebration to honor her. This short video celebrates her generosity, and this article: One Vision, Many Futures: Nonprofits Reflect on the Power of Planned Giving highlights the impact Mary’s gift is having on Vermont.

If you have included Shelburne Farms in your estate plans, please let us know so we may thank you personally. For more information about becoming a member of our Legacy Circle, please contact: Sue Dixon, sdixon@shelburnefarms.org or call her at 802-985-0322.

Elizabeth Ferry

I included Shelburne Farms in my will for so many reasons. Among them: the farm’s incredible land, water, and air; the organization’s leadership in food and place-based education; and the spirit of hospitality extended by the staff. Each time I visit the farm I feel my spirit soar. To know that I can be part of the farm’s evolution beyond my lifetime — well, that feels like a gift to me.

Emily and Paul Morrow

Emily and Paul Morrow enjoy the best of all worlds. After successful careers practicing law and medicine in Vermont, they are now residents of New Zealand where Emily is a consultant and Paul is retired.

The Morrows return to Vermont in the summer. You may run into Emily walking the trails at Shelburne Farms or find Paul enjoying the sunset from their home overlooking Lake Champlain in Shelburne.

“I look at my life in chapters,” recalls Emily, who was a practicing tax attorney for 25 years and served on the Shelburne Farms board from 1987 to 2005. She and Paul have been supporting Shelburne Farms for more than three decades.

Emily and Paul are helping to fund this chapter of life with quarterly payments from a Charitable Gift Annuity (CGA) established to benefit Shelburne Farms. This is the Morrow’s second CGA to benefit Shelburne Farms through the Vermont Community Foundation. To learn more about establishing a CGA that pays you income for life and then benefits Shelburne Farms, contact Sue Dixon: sdixon@shelburnefarms.org or call her at 802-985-0322.

Dan and Carol Wilson

From the time we first visited Shelburne Farms 30 years ago, we’ve been impressed with the beauty of the working farm, with the pleasures of the Inn, with the careful stewardship of the land, and with the educational ventures for children and adults. We have included a bequest to Shelburne Farms in our will so that this marvelous place will continue its good work for many years to come.

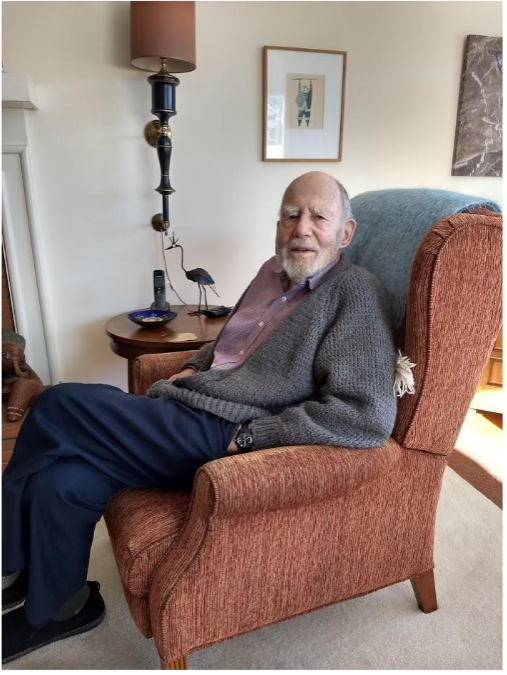

Dieter Gump

“I can’t remember a time when I didn’t know Shelburne Farms,” recalls Dieter Gump, emeritus professor of medicine at the University of Vermont.

A few years ago, Dieter and his wife Valerie discovered a paid-in-full life insurance policy that they no longer needed. Dieter requested a “change of beneficiary form” from his plan administrator and named Shelburne Farms as the beneficiary of the policy. No lawyers, no fees – it was that simple: Dieter and Valerie fulfilled their dream of becoming Shelburne Farms legacy circle members.

Entirely separate from your will, beneficiary designation is one of the easiest ways to make a legacy gift. Beneficiary designations may be adjusted at any time. Simply submit a “change of beneficiary” form to your plan administrator, naming Shelburne Farms as a beneficiary of your policy. It’s that simple!

Shirley Murray

Never one to idle, Shirley Murray took up volunteering at Shelburne Farms after retiring from teaching kindergarten. Thus began a friendship that would span decades. Shirley’s curiosity and love of learning made her a natural fit volunteering with our historic Archives & Collections. She spent countless hours reading and transcribing Lila Webb’s journals. When Shirley passed away at age 93, she left a legacy of love that connects us to the past through her work with Lila’s journals. Shirley also left a bequest to Shelburne Farms Endowment Fund that will enable us to continue to strengthen our mission-driven work well into the future. We are deeply honored by Shirley’s dedication as a volunteer and by her thoughtful estate planning.

Judy Brook

Every day, Shelburne Farms inspires me as a teacher, learner, poet, artist, photographer – and, yes, as a philanthropist. The Farm is an amazingly beautiful 1,400-acre classroom for teaching sustainability. It’s a place where the highly skilled, friendly, and knowledgeable staff explore with students, replace old pipes, grow food, cook and clean; and it’s where creative teachers lead classes, camps, and conferences that support children and all who want to make the world a better place.

Working through my professional advisor, I created a Trust that shall continue providing monetary support for Shelburne Farms long after I’m gone, carrying my values into the future. I hope you are inspired to join me in expressing gratitude and sharing the abundance. – Judy Brook

Questions?

Through careful gift planning, people often discover that they are able to have even greater impact than they had imagined possible. Bequests naming Shelburne Farms as beneficiary help to ensure that the Farm’s groundbreaking EFS (“Education for Sustainability”) programs and partnerships continue engaging young people – along with their guiding families, teachers, & elders – to shape healthy and just communities worldwide.

Contact